Can you get there from here?

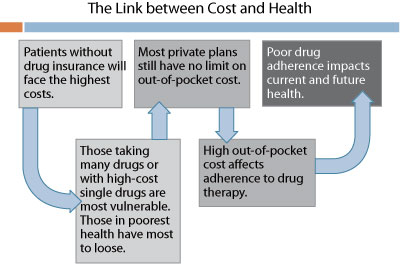

bh IN BRIEF Three provinces have embarked on significant changes to drug policy that affect private plan sponsors. As the provinces again act to control their costs, the pharmacy industry is likely to raise prices elsewhere to compensate. Many private plans are exposed, even though the Ontario government has offered partial protection. No less important, there are potential health impacts for those without plans, and those with private plans that have no catastrophic cost protection. As the dust settles it should become clear that drug plan stakeholders depend on each other, and inclusive, constructive dialogue must begin again. | Chris Bonnett, Editor, Businesshealth. First it was Alberta, then Ontario, and now British Columbia is about to announce a new approach to generic drugs and managing the pharmacy industry. Clearly, pharmacy has been the favourite target this time, and a formidable opponent in protecting its business interests. While I can’t blame them for this, their approach has been generally clumsy in Ontario. Among many missteps, the Ontario government has alleged that the pharmacy industry received $750 million (annualized) in professional allowances from generic drug companies in 2009 that are legally directed to patient care, but "70 per cent…[has] actually gone toward fringe benefits, bonuses, overhead costs and boosting profits…".1 The Ministry says over 650 (about 20% of) pharmacies submitted incomplete documentation of these allowances, and up to 100 provided no information at all. The response of the big chains has been to cut hours, threaten patient service cuts, and raise prices…starting in the Minister’s home riding. Drug cards from Medavie Blue Cross and Green Shield have been refused, though all is now normal with both carriers. Patients can be excused for feeling like pawns. While the media has focused on the government, it’s important to note that privately insured drug plans pay as much collectively as provincial drug plans for prescription drugs – almost $10 billion nationally. The Ontario changes, to the extent they are finally implemented, are better than what employers and insurers received in 2006, but leave important gaps through which pharmacy could and presumably will drive large increases. The May 2010 edition of Green Shield’s The Inside Story (available at www.greenshield.ca) has a great summary of proposed changes. It notes that employers are not protected from increases in drug cost mark-ups and dispensing fees, and that the price of generic drugs not on the Ontario Drug Benefit formulary will not be controlled. Any place without regulation is likely to again witness the proverbial ‘squeeze-the-balloon’ effect from government plans to private plan sponsors. Any plan without appropriate controls – in particular reimbursement plans – will witness additional adverse effects. Private plan sponsors in other provinces should also beware. There has been extensive (and most welcome) dialogue between the Ontario Ministry of Health and Long-Term Care and the private payer community. That was an important forum to achieve new controls this time. How would this play out in other provinces that do not have the critical mass of insurer, PBM, and consultant head offices existing in Ontario? We should also consider the health impacts of changes, which may be illustrated with the following chart:

Health plans, including drug plans, have important impacts on the health of plan members. It isn’t just about price and cost, so much as about deriving value from these investments in the workforce. While the finances are easy to quantify, it is the health effects that create most of the value for employers, along with the goodwill and loyalty generated by offering high quality plans. Perhaps the most important issue in this epic struggle will be how to repair the damage. The invective hurled and bluster unfurled has pitted groups against each other that actually need each other in an ironically symbiotic tension. In the end, pharmacies must compete for customers, and they depend on the goodwill of employers for half their revenue. Employers, for their part, need their drug plans to run smoothly and that requires pharmacies to make a fair return. They may need certain pharmacy professional services to help keep plan members healthy and productive. Insurers and PBMs need to demonstrate to their clients that they are being tough and fair, controlling government cost-shifting, and earning their fees by fulfilling their fiduciary duties. While we are now experiencing the second major wave of reform in Ontario, it will not be the last. To quote George Santayana, the Spanish-American philosopher: "Those who cannot remember the past are condemned to repeat it." There is plenty of need for the skills and abilities of each player now playing in the benefits field; let’s look for ways to make this anything but a zero-sum game.

|